Today, 10 January 2024, the Ministers of Economic Affairs and Climate Policy and for Foreign Trade and Development Cooperation informed the House of Representatives about the achieved milestones in their ambition of strengthening the Dutch Semiconductor ecosystem.

The full official text can be found here (only in Dutch).

The unofficial translation of the text is displayed below.

The Hague, December 21, 2023

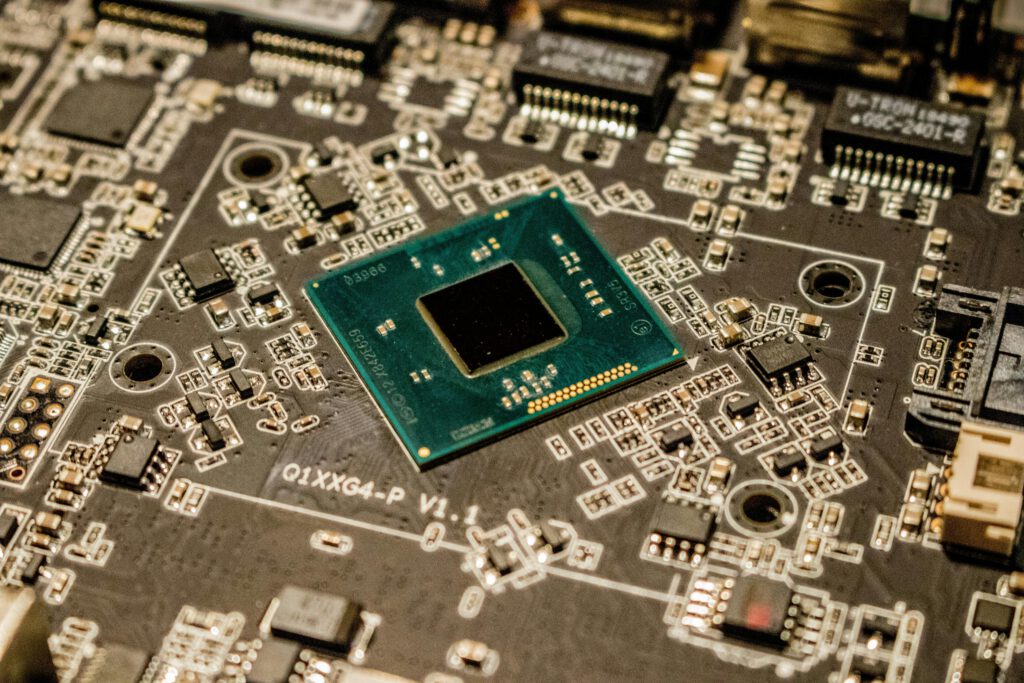

Microchips (semiconductors) play a crucial role in daily life, both now and in the future. They are found in smartphones, electric cars, and medical equipment, among other things. During the COVID-19 pandemic, there was a temporary shortage of semiconductors, leading to a reduction in available medical devices and computers. By increasing development and production in the Netherlands and the European Union, the aim is to prevent such shortages in the future. It is essential to foster the growth of the semiconductor industry while ensuring resilience. The Netherlands is part of a select group of countries playing an indispensable role in semiconductor production.

In earlier letters, this government shared its ambitions with your Chamber to strengthen the Dutch semiconductor ecosystem. The increasing demand for semiconductors and shifting geopolitical and geo-economic relations make the realization of these ambitions urgent. We are pleased to inform your Chamber that significant milestones have been achieved in recent months towards realizing these ambitions. This letter provides further details on these milestones, focusing particularly on developments related to the European Chips Act and the Important Project Of Common European Interest Micro-Electronics & Communication Technology (IPCEI ME/CT). Additionally, various components of semiconductor technology will be well-represented in the National Technology Strategy, which will be further communicated to your Chamber in early 2024.

Changing geopolitical relations, a challenged business climate, and global government interventions in the value chain mean that the Dutch position in the global semiconductor ecosystem is not a given. Extra steps are required to ensure that we have sufficient chips for our devices in the future, that the growing sector continues to contribute significantly to our earning capacity, and that the Netherlands remains an international player.

Together with the industry and the knowledge field, the government is committed to growing the market share of Dutch semiconductor companies within the global value chain over the next ten to fifteen years. This goal can only be achieved by focusing on underlying policy priorities. These priorities include the business climate, talent development, physical space for growth, protection of knowledge and technology, and international partnerships to promote our ambitions. Action agendas on these five policy priorities will be developed in the coming period. Consistent and reliable government policy is essential to promote certainty for companies and stimulate long-term investments.

The first part of this letter provides a brief overview of the Dutch semiconductor ecosystem. It is followed by an overview of the policy priorities that the government will implement now and in the future, along with milestones related to the Chips Act and the IPCEI ME/CT. Finally, this letter provides an initial insight into the collaborative platform where the government, knowledge institutions, and industry will work together to realize the aforementioned policy priorities.

Dutch Semiconductor Ecosystem

The Dutch semiconductor ecosystem consists of around 300 companies and knowledge institutions, mainly concentrated around the Technical Universities in Eindhoven, Delft, and Twente. Important semiconductor companies are also located in and around Almere and Arnhem/Nijmegen. This clustering of activities around universities and colleges reflects the intensive collaboration between these companies and knowledge institutions, forming the basis of the Dutch ecosystem’s strong innovation position. The figure below provides a general overview of Dutch activities in various segments of the semiconductor value chain. Dutch companies and knowledge institutions are active throughout the value chain, with a strong presence in local and regional supply chains and partnerships.

* Companies and knowledge institutions can be active in more than one segment of the value chain. The above overview includes the photonics ecosystem.

** Pure Play Foundries with foreign owners are included under ‘Service Providers’ (e.g. Sales) if they do not have foundry activities in the Netherlands.

*** IDMs with foreign owners are included under ‘Service Providers’ if they do not have full IDM activities in the Netherlands.

Netherlands has a unique position in machine construction with global players such as Besi, ASM, and ASML. This cannot be separated from the strong embedding in the regional network of suppliers, including TNO, VDL ETG, Neways, NTS Group, and Pro Drive. The SME sector plays a significant role in this cluster, with several highly innovative and globally active companies such as Salland Engineering, Nearfield Instruments, and Trymax. In the field of analog chips, companies like NXP and Nexperia are active in the Netherlands. Additionally, the Netherlands has potential in chip design, packaging, and photonic chips. Dutch photonic companies such as SMART Photonics and EFFECT Photonics, through PhotonDelta, benefit from the high-quality knowledge of existing semiconductor companies, giving the Netherlands an essential position. Earlier this year, the Dutch government, along with ASML, NXP, and VDL Groep, allocated €100 million for the Eindhoven photonic chip factory SMART Photonics. Although not formally part of the Dutch ecosystem, the collaboration of Dutch semiconductor companies with the Flemish research institute Imec is noteworthy. The Veldhoven-Leuven axis is decisive for the speed of innovations in the global semiconductor sector and forms the heart of the European ecosystem. This unique collaboration within the complex semiconductor value chain requires further strengthening beyond national borders.

A Strong Dutch Ecosystem with European Integration

The dynamics of the global geopolitical balance are undergoing significant changes. These changes have implications for the economic positions of countries and regions worldwide. We are witnessing the emergence of geopolitical tensions, trade wars, and protectionism, leading to strategic considerations concerning supply chain dependencies. The semiconductor sector is a striking example of these dynamics. It is a highly interconnected and globalized industry, which at times makes it vulnerable to geopolitical and geo-economic shifts. Semiconductor manufacturing is concentrated in a few countries, creating a situation where the industry is dominated by a limited number of companies and locations. This concentration poses risks to the global supply chain.

The Dutch semiconductor ecosystem, with its strength in machine construction, photonic chips, and analog chips, plays a crucial role in the global semiconductor industry. However, to maintain and strengthen this position, the government, industry, and knowledge institutions must join forces. The global challenges faced by the semiconductor sector require a collaborative, European approach. This includes a focus on critical parts of the value chain, an increase in research and development, and the development of joint strategies to respond to global developments. The Netherlands has the ambition to take on a pioneering role in this European collaboration.

Policy Priorities for a Competitive and Resilient Semiconductor Ecosystem

To achieve the ambitions set for the Dutch semiconductor ecosystem, the government, industry, and knowledge institutions will focus on five policy priorities:

1. Business Climate: The Netherlands must have an attractive business climate to ensure semiconductor companies want to establish or expand their activities here. The government will actively monitor and improve the business climate for the semiconductor sector in collaboration with the industry. It will address bottlenecks and contribute to a favorable environment for innovation and investments.

2. Talent Development: The availability of skilled personnel is crucial for the growth of the semiconductor ecosystem. The government, in collaboration with the industry, will invest in training and education programs to ensure the availability of a skilled workforce. Efforts will be made to attract international talent and to strengthen cooperation between the semiconductor industry and educational institutions.

3. Physical Space for Growth: The semiconductor sector requires space for research, development, and production activities. Spatial constraints in the Netherlands necessitate strategic decisions on the allocation of suitable locations for semiconductor-related activities. The government will work closely with municipalities and provinces to address spatial challenges and facilitate the necessary space for the growth of semiconductor companies.

4. Protection of Knowledge and Technology: The protection of intellectual property, trade secrets, and key technologies is essential in the semiconductor sector. The government will collaborate with the industry to establish measures to protect knowledge and technology from unwanted transfer and theft. This includes strengthening cybersecurity measures and promoting a culture of responsible innovation.

5. International Partnerships: The global nature of the semiconductor industry requires international collaboration. The government will actively engage in European and international partnerships to strengthen the position of the Dutch semiconductor ecosystem. This includes collaboration within the framework of the European Chips Act and the IPCEI ME/CT, as well as bilateral collaborations with key partners.

Milestones and Developments

The Dutch government has made significant progress in recent months towards achieving the goals set for the semiconductor ecosystem. Key milestones and developments include:

* European Chips Act: The government is actively involved in the development and implementation of the European Chips Act. This legislative framework aims to strengthen the European semiconductor industry by addressing key challenges and promoting investments in research, development, and production. The Netherlands supports the objectives of the European Chips Act and actively contributes to its formulation.

* IPCEI ME/CT: The Important Project Of Common European Interest Micro-Electronics & Communication Technology (IPCEI ME/CT) is a European initiative to support and strengthen the semiconductor and communication technology sectors. The Dutch government, in collaboration with industry partners, is actively participating in the IPCEI ME/CT. This initiative involves joint investments in key technologies, research, and innovation projects to enhance the competitiveness of the European semiconductor ecosystem.

* National Technology Strategy: The National Technology Strategy, scheduled to be communicated to your Chamber in early 2024, will provide a comprehensive overview of the government’s approach to promoting technological innovation and development. It will include specific components related to semiconductor technology, reinforcing the government’s commitment to advancing the Dutch semiconductor ecosystem.

* Collaborative Platform

Realizing the ambitions for the Dutch semiconductor ecosystem requires close collaboration between the government, knowledge institutions, and industry. A collaborative platform will be established to facilitate ongoing dialogue, coordination, and joint decision-making. This platform will serve as a forum for addressing emerging challenges, sharing knowledge, and aligning strategies to ensure the continued growth and resilience of the semiconductor ecosystem.

In conclusion, the Dutch government is committed to fostering a competitive and resilient semiconductor ecosystem in collaboration with industry and knowledge institutions. The priorities outlined in this letter reflect the government’s dedication to creating an environment conducive to innovation, investment, and international collaboration. The government will continue to actively engage with relevant stakeholders, monitor progress, and adapt policies as needed to achieve the shared goals for the Dutch semiconductor ecosystem.

We look forward to keeping your Chamber informed about further developments and progress in the realization of our ambitions for the semiconductor sector.

The Minister of Economic Affairs and Climate,

Sigrid Kaag

The Minister for Foreign Trade and Development Cooperation,

Stef Blok